Advocacy Update 2024 - Legislative Days 33-35

As is typical following Crossover Day, this week saw limited action on the floor while committees were seemingly active around the clock to consider more than 150 bills and resolutions. Those that come out of committee are eligible for a vote by the full chambers during the final stretch of this year’s General Assembly.

As is typical following Crossover Day, this week saw limited action on the floor while committees were seemingly active around the clock to consider more than 150 bills and resolutions. Those that come out of committee are eligible for a vote by the full chambers during the final stretch of this year’s General Assembly.

While the legislature considers thousands of measures each session, there is only one item that they are constitutionally required to act on – the state budget. The $36.1 billion spending plan was drafted by the Governor’s administration and has already passed the House. The Senate is making final amendments to their version and will formally adopt it next week. Then both chambers will spend the final days in negotiations, all the while using budget items to leverage unrelated policy measures as the session wanes.

Study Committee on Credit Card Fees (HR 1135)

Study Committee on Credit Card Fees (HR 1135)

Rep. Todd Jones, R—South Forsyth

Resolution approved by the Agriculture and Consumer Affairs Committee on Mar 12th

The Resolution creates a House Study Committee on Credit Card Fees on State Sales and Excise Tax and their impact on Georgia merchants and consumers. The resolution outlines who the ten members of the committee would include:

- Four members of the House of Representatives, including the Chairman of the House Banks & Banking Committee and the Chairman of the Technology and Infrastructure Innovation

- Six nonlegislative members:

- One retail payments expert from a motor fuel or general retailer

- One banking industry expert

- One consumer member or consumer advocate

- One payment-processing expert from a processing company

- One restaurant owner-operator or representative from the restaurant industry, and

- One small business owner or operator or a small business representative

The study would explore various subjects, including the purpose and breakdown of credit card swipe fees, the role of merchants in addressing fraudulent transactions, the volume of fraud liability imposed upon merchants through chargebacks, the impact of swipe fees on low-income consumers, the anti-competitive nature of payment card marketplace, and the ability of merchants to communicate tax amounts based on information already provided as part of the transaction.

CBA and other members of the financial services section testified on this Resolution during the Committee meeting. CBA stands firm in its position that a solution should be sought at a federal level and not at the state level. Click here to watch the hearing.

Georgia Firearms Industry Nondiscrimination (HB 1018)

Georgia Firearms Industry Nondiscrimination (HB 1018)

Rep. Jason Ridley, R—Chatsworth

Bill approved by the Senate Banking & Financial Institutions Committee on Mar 13th

The bill relates to the merchant category code or any other indicator that a financial institution assigns to a merchant or to a payment card transaction that identifies whether the merchant is a firearms retailer or whether the payment card transaction involves the purchase of a firearm or ammunition. The National Rifle Association (NRA) passed similar legislation in Mississippi and the intent of HB 1018 is to mirror that. While a large portion is identical to MS legislation, these differences will cause issues for Georgia’s financial institutions if not corrected. Rep. Ridley agreed to all but one change requested by the financial services trade group. The one change not made relates to the definition of “firearms code” and the codes created by the International Organization for Standardization (ISO).

Veterans Benefits (SB 451)

Veterans Benefits (SB 451)

Sen. Nabilah Islam Parkes, D—Duluth

Bill approved by the House Defense & Veterans Affairs Committee on Mar 13th

The bill as originally introduced was gutted and replaced with new language. The bill was amended again in the House Defense & Veterans Affairs Committee to prohibit pawnbrokers from making title pawns to active duty military and their dependents. The substitute version no longer has any language relating to a loan program administered by the Department of Banking & Finance.

Central Bank Digital Currency (HB 1053)

Rep. Carter Barrett, R—Cumming

Bill approved by the Senate Banking & Financials Institutions Committee on Mar 12th

The bill prohibits governmental agencies from using central bank digital currency as payment and from participating in testing the use of such currency.

Mortgage Trigger Act (HB 1040)

Rep. Scott Hilton, R—Peachtree Corners

Bill approved by the Senate Banking & Financial Institutions Committee on Mar 12th

The bill prohibits unfair or deceptive practices in consumer transactions related to mortgage trigger leads. Essentially, it bars credit reporting agencies from selling consumers’ contact information when they apply for a residential mortgage. ICBA has advocated for the ‘trigger leads’ bill that was introduced in the U.S. House of Representatives on Feb 8th. CBA provided feedback to the author on how to strengthen the intent based on feedback received from ICBA on this issue. The author may work on changes in the Senate if the bill crosses over.

Remote Online Notary (SB 425)

Remote Online Notary (SB 425)

Sen. Blake Tillery, R—Vidalia

Bill approved by the House Judiciary Committee on Mar 12th

The bill provides for the modernization of certain legal, notarial, and court services by electronic means. It allows an attorney to conduct a real estate closing for property in this state using electronic means under certain conditions. Attorneys in the financial institutions sector are currently reviewing the bill to determine if there are any major concerns with it as introduced.

One change for some financial institutions is the requirement that any real estate loan must be closed by an attorney. Some institutions have done HELOC and refinance closings at the institution with no attorney present. If passed, the bill will require a change in procedures for these types of closings.

The Remote Online Notary bill last was debated as HB 334 in 2022. At that time, Sen. Blake Tillery opposed the legislation and SB 425 is his attempt at perfecting it. Conceptually, CBA supports the use of a Remote Online Notary and remains hopeful that the parties can reach an agreement.

Changes were made to the bill relating to commercial real estate closings and ensuring that these closings were not part of the bill. The bill is only intended to cover 1-4 residential properties.

Georgia Higher Education Assistance Corporation (HB 985)

Rep. Chuck Martin, R-Alpharetta

Senate passed the bill with a vote of 55-0 on Mar 13th

The bill abolishes the Georgia Higher Education Assistance Corporation.

College Success 529 Expansion Act (SB 469)

Sen. Jason Esteves, D—Atlanta

Bill approved by the House Higher Education Committee on Mar 13th

The bill increases the maximum amount of contributions allowed to the GA Higher Education Savings Plan per beneficiary of savings trust accounts for higher education expenses.

[PROPERTY]

Possessory Interest in Certain Land by Foreign Persons (SB 420)

Sen. Jason Anavitarte, R—Dallas

Bill approved by the House Agriculture and Consumer Affairs Committee on Mar 12th

The bill prohibits the acquisition of possessory interest in certain land by certain foreign persons and entities.

[JUDICIAL]

Adult Abuse, Neglect, and Exploitation Multidisciplinary Team (HB 1123)

Rep. Carter Barrett, R—Cumming

Bill approved by the Senate Judiciary Committee on Mar 12th

The bill establishes an Adult Abuse, Neglect, and Exploitation Multidisciplinary Team in each judicial circuit. An Elder Justice Coalition for the State of Georgia shall also be created. CBA worked with the author of the bill to have the Association included as part of this coalition, which was part of the substitute passed by the committee.

COVID-19 Pandemic Business Safety (SB 430)

Sen. Greg Dolezal, R—Cumming

House passed the bill with a vote of 146-27 on Mar 13th

The bill revises provisions for rebuttable presumptions of risk by claimants in certain COVID-19 liability claims by repealing certain warning requirements. The liability protections remain in place, but the legislation removes the need for the warning signs that became ubiquitous during the pandemic.

Appellate Jurisdiction (SB 450)

Sen. John Kennedy, R—Macon

House passed the bill with a vote of 150-0 on Mar 14th

The bill clarifies that neither superior court nor a state court has appellate jurisdiction over any non-appealable order of a probate court relative to property, wills, trusts, and administration of estates.

[TECHNOLOGY]

Georgia Consumer Privacy Protection Act (SB 473)

Sen. John Albers, R—Roswell

Bill heard by the House Technology, Infrastructure and Innovation Committee on Mar 13th

SB 473 protects the privacy of consumer personal data, defined as information that is linked or reasonably linkable to an identified or identifiable individual. It allows a consumer to invoke these rights, including correcting inaccuracies, deleting personal information, obtaining a copy of their personal information, opting out of the processing of their personal information, etc. The controller of personal data is obligated to limit the collection of such information to what is adequate, relevant, and reasonably necessary.

Legislation that fails to meet the Crossover Day deadline is lost as a standalone measure this year. However, the entire contents of “dead” bills can be added to unrelated active legislation. This is an especially fraught time of the session, where each amendment and committee substitute must be carefully reviewed to ensure nothing slips through unnoticed. CBA is monitoring amendments and substitutions closely.

Legislation that fails to meet the Crossover Day deadline is lost as a standalone measure this year. However, the entire contents of “dead” bills can be added to unrelated active legislation. This is an especially fraught time of the session, where each amendment and committee substitute must be carefully reviewed to ensure nothing slips through unnoticed. CBA is monitoring amendments and substitutions closely.

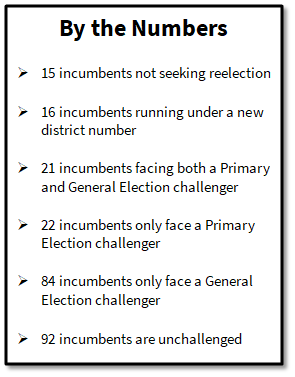

All 236 members of the Georgia General Assembly stand for election later this year, as does Georgia’s US Congressional delegation, and several members of the state’s Supreme Court and Court of Appeals.

With races for the state’s top posts still two years away, there have not been significant vacancies created by incumbents seeking higher office. This is sure to be the case in 2026, when Governor Brian Kemp is term-limited and several other constitutional officers are already indicating they intend to run.

There have been high-profile retirements, including the top Democrats in both the House and Senate, Rep. James Beverly, and Sen. Gloria Butler, respectively. The House is also losing two Appropriations subcommittee chairs, Rep. Penny Houston, and Rep. Clay Pirkle.